Loan Qualification Checklist

Check your rate in 5 minutes or less

Verify your information

Accept your money

No, it’s not money borrowed from your rich uncle, or anyone else you know “personally.” The term refers to money borrowed from a lender that is not secured by property such as a house or car over a fixed period of time.

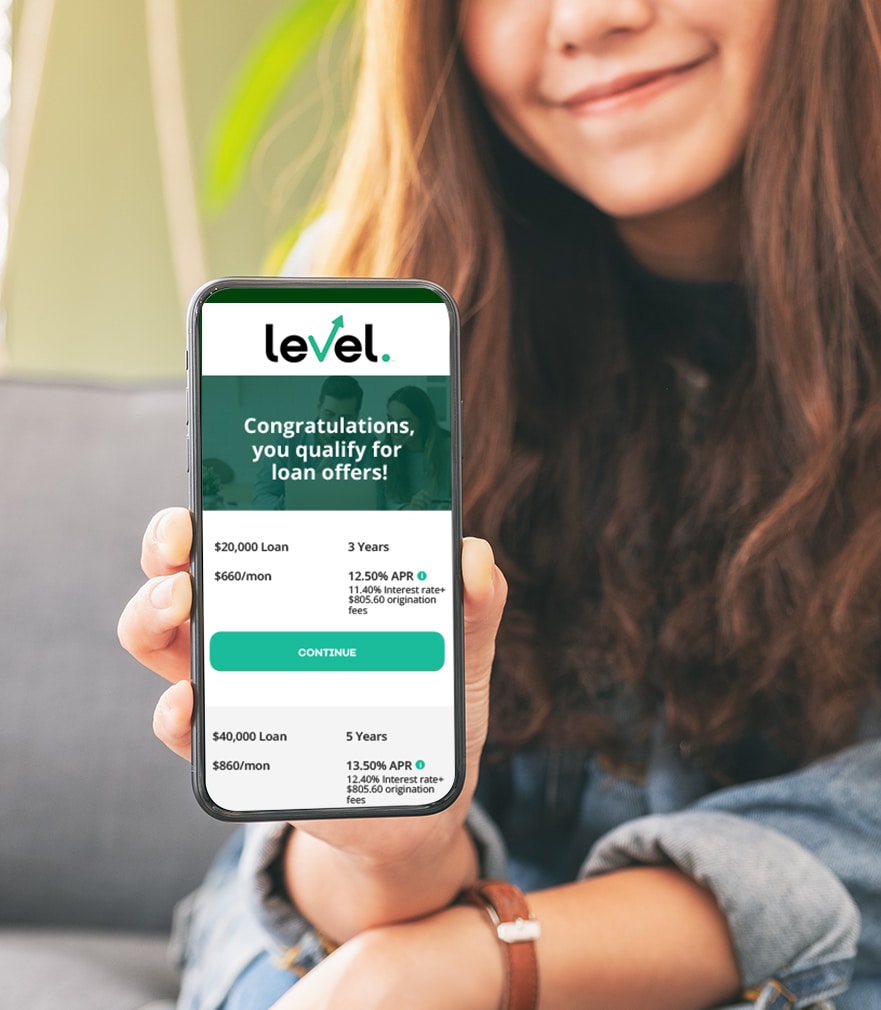

Once approved, you’ll be qualified to receive a Level loan anywhere from $15,000 to $250,000.

Wanting a loan doesn’t always mean you should get one. A credit score below 670 may render you ineligible, or yield a loan offer with such high interest and repayment terms that adding new debt may be counterproductive. Sometimes it’s better to focus on improving your credit score before taking on more debt. But don’t panic. Level Financing offers a powerful alternative.

Checking your rate on Level Financing will not affect your credit score. If you proceed with your application after receiving a rate, your credit score may be affected. When you check your rate, we make a “soft credit inquiry.” Soft credit inquiries on your report do not lower your credit score, but you may see when you view your report that this inquiry was made. If you are offered a loan and proceed with the application, a “hard credit inquiry” will be completed to verify the accuracy of your application. This action will be recorded as an inquiry on your report and it may affect your credit score.

There is no prepayment penalty for paying off a Level Financing loan early. You may pay off part or all of the loan at any time with no fee. By prepaying, you will pay less overall interest because the loan is outstanding for a shorter time.

*Level Debt is partnering with Premlo Loans, an affiliate of GRT, to assist in servicing loans to our clients. Loan requests of $10,000 or more are determined by having a credit score of 670 or higher, a clean credit history, no late payments, no derogatory marks within the last three years, and $5,000 or more monthly individual income with a verifiable income source. Available in all 50 states.

**When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will affect your credit score. If you take out a loan, repayment information will be reported to the credit bureaus.